- #421

ThomasT

- 529

- 0

Do you really think so? I don't see the US as having Greece-type economic problems ... ever.apeiron said:So we are still on track for economic adjustments like we are seeing in Greece right now.

Do you really think so? I don't see the US as having Greece-type economic problems ... ever.apeiron said:So we are still on track for economic adjustments like we are seeing in Greece right now.

ThomasT said:Do you really think so? I don't see the US as having Greece-type economic problems ... ever.

Recent drilling rates are much higher as that EIA data shows: 20.5 thousand gas wells per year 2007-9. Yes these frac wells are much more expensive, but the US industry as a whole is also drilling 3X fewer feet of dry hole than they were back in (say) the 1960s, and that's against today's higher drilling rate.CaptFirePanda said:Since the 1980's the US had drilled about 220,000 gas wells so the 150,000 number equates to about 25 years of drilling (certainly not an overnight fix). Also with gas prices where they are now, it would take a lot of incentive and recovery for anyone to keep pace with historical rates of drilling (especially when drilling techniques are far more expensive).

I was referring to actual oil, and was estimating how many shale oil wells would be required for domestic production to meet consumption. The N. Dakota (Bakken) per well average is 86 bpd.By 100 bbl/day are you talking "barrel of oil equivalent" (BOE)? ...

I don't understand. These are, afaik, vast oil resources. Peak oil is about exploitable resources, isn't it?SixNein said:No, in fact, those unconventional sources are a sign of peak oil. But understand, peak oil is more of a misnomer for cheap oil.

Yes, and falling. Product supplied as of last week was down to 18.054 mbpd (4 week average), or 1.2 mbpd less than the same time last year. The last time US petroleum consumption was below the current level was March of 1997CaptFirePanda said:No, not falling. Recovering perhaps, but definitely not falling.

But there's not exponential growth wrt consumption of fossil fuels, is there? Yes, consumption is increasing. But so can production. At least, as far as I can tell, for the next century ... and maybe a lot longer.MarcoD said:The problem is exponential growth with limited resources.

ThomasT said:I don't understand. These are, afaik, vast oil resources. Peak oil is about exploitable resources, isn't it?

By 2012, surplus oil production capacity could entirely disappear, and as early as 2015, the shortfall in output could reach nearly 10 million barrels per day

..

..

..

While it is difficult to predict precisely what economic, political, and strategic effects such a shortfall might produce, it surely would reduce the prospects for growth in both the developing and developed worlds. Such an economic slowdown would exacerbate other unresolved tensions, push fragile and failing states further down the path toward collapse, and perhaps have serious economic impact on both China and India."

mheslep said:Recent drilling rates are much higher as that EIA data shows: 20.5 thousand gas wells per year 2007-9. Yes these frac wells are much more expensive, but the US industry as a whole is also drilling 3X fewer feet of dry hole than they were back in (say) the 1960s, and that's against today's higher drilling rate.

I was referring to actual oil, and was estimating how many shale oil wells would be required for domestic production to meet consumption. The N. Dakota (Bakken) per well average is 86 bpd.

Thanks for the well sourced replies. More later ...

That conclusion is not justified, especially given the recession was Fall 2008 and imports have has been falling since 2005. Yes economic slow downs deserve some of the blame for energy imports and consumption, but other factors apply apply including improvements in economic energy intensity and increase in domestic supply:CaptFirePanda said:The over-riding reason behind those recent drops in consumption/import numbers is the extremely significant recession that we experienced in 2008.mheslep said:Since 2005 the gap has closed significantly as those graphs show, and are continuing to close. US oil imports have dropped ~25% since the peak back then.CaptFirePanda said:That's all well and good, but since the 1980's the gap between US production and consumption has widened significantly.

A fair point. Note though that energy prices have a way to go before they are constant around the world, and exports to the highest bidder immediate. Natural gas for instance is priced overseas at several multiples of the of the US price (for now). Bakken oil sells at a $30/bbl discount locally (for now). I doubt a squeeze in supply meeting demand becomes serious enough to stop a build out in more energy infrastructure.I could substitute any sort of energy source in there but it doesn't make your point any more valid. All I have to do is expand the picture to global consumption because, as we know, the US is not the only consumer of hydrocarbons in the world and there are at least 2 developing countires that will more than pick up any slack US citizens are willing to give.

The depends on the efficiency of the biofuel method and the consumption at the time. That 500 bbl/acre-year engineered bacteria approach (should it work) requires 13 million acres to meet all of US current consumption (18 mbbl/day). That compares well to the 90 million acres in use currently for all US corn crops, not that such an approach needs arable land.As I've mentioned, land-use issues will inevitably arise with respect to any of these sorts of technologies. Whether they are taking up arable land or otherwise, there will be significant limitations on how large they can grow.(I like this one at 500 bbls/acre-year). I don't know what may or may not work, but once an approach is proven I have little doubt of industrial ability to scale up rapidly - as shown by corn ethanol.

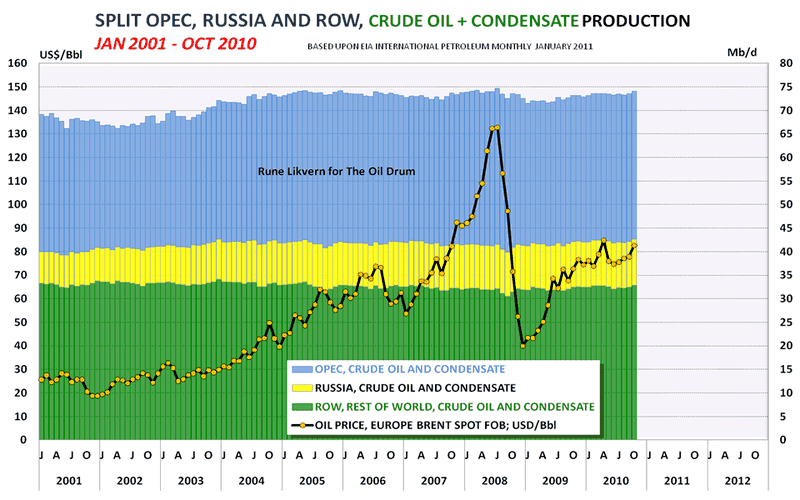

From the graph, it doesn't seem to me that the price of oil has anything to do with supply and demand. Maybe you can explain it to me.SixNein said:The textbook definition is the peak production of oil.

And there is reason to believe we might have peaked out on production. For example, oil prices have been rapidly increasing over the last decade while production has been hanging out on a plateau. Economics would suggest a constrained supply.

And the military says this:

http://www.jfcom.mil/newslink/storyarchive/2010/JOE_2010_o.pdf

Make no mistake... the problem is quite serious.

There are many different types of oil fields. For the most part, we have been getting most of our oil from conventional oil wells. These are very easy to extract oil from, and they have the highest EORI. The production on this type of field has peaked and is entering decline. Part of the problem is replacing the lost production with other sources be it shale, ethanol, or tar sands. These are more intensive to produce and have lower EORI. In a basic nutshell, the industry will need to flat our run in order to stand still.ThomasT said:From the graph, it doesn't seem to me that the price of oil has anything to do with supply and demand. Maybe you can explain it to me.

So, what, exactly, is the problem? As far as I can tell there's no current shortage of oil. And prices rise and drop more or less arbitrarily.

http://en.wikipedia.org/wiki/Automotive_industry_in_the_People's_Republic_of_ChinaThe number of registered cars, buses, vans, and trucks on the road in China reached 62 million in 2009, and is expected to exceed 200 million by 2020, though by 2050 it will be surpassed by neighbouring India and be pushed to second place in total automobiles.[

SixNein said:In a basic nutshell, the ultimate problem is gas prices are going climb.

brainstorm said:I was in the middle of a detailed response message when the power went out and I lost my work. Ironic that it happened while I was posting about energy developments! Anyway, the main issue, imo, is that people can't expect that current consumption patterns are going to magically cause solar power, fossil fuel supply, or any other aspect of energy resourcing to behave in ways they expect it to. People act as if the energy sources have to meet their cultural expectations instead of the other way around. If solar doesn't work it night, it may be that people are going to have to adapt their cultural patterns to go without electricity at night. It may not be necessary to do this right away or all at once, but it makes more sense to me that if you estimate that eventually it will be inevitable that you would rather transition slowly than wait for the sh*t to hit the fan, so to speak.

Very good point and likely imo. There is simply no way we can meet demand for everyone in the world to consume energy like Americans.

Currently, I believe the political-mechanical issue is whether free-markets are suited to adapt to energy production and consumption needs for the future. Presumable with valid knowledge about the future they would be, but the problem is that market interests themselves exert influence on future-knowledge in a way that suits short-term profit-motives and consumer-habits. In short, consumers are willing to pay to be told what they want to believe, even if that means making the disaster worse in the long run. Many people simply don't believe there's any disaster even coming - that it is just a trick on the part of people who want to generate cultural change.

The biggest question is whether government should allow solar developments to get priced out of the market, or whether some combination of subsidies and business-model intervention could push the solar-energy industry in the direction of making technologies more accessible, affordable, and therefore widespread. Of course, if existing energy-interests decide that growth of solar is going to interfere with their ability to maintain infrastructure with a narrower customer base, they will probably focus on preventing solar from gaining market share, just because they need the money to continue funding their operations, which they have a stake in maintaining.

talk2glenn said:it is relatively common knowledge that world reserves today are larger than they were in the past.

.

.

.

The only standard is the prescisely defined proved reserves, which are subject to regulation and verification.

http://www.guardian.co.uk/business/2011/feb/08/saudi-oil-reserves-overstated-wikileaksThe cables, released by WikiLeaks, urge Washington to take seriously a warning from a senior Saudi government oil executive that the kingdom's crude oil reserves may have been overstated by as much as 300bn barrels – nearly 40%.

I see.SixNein said:There are many different types of oil fields. For the most part, we have been getting most of our oil from conventional oil wells. These are very easy to extract oil from, and they have the highest EORI. The production on this type of field has peaked and is entering decline. Part of the problem is replacing the lost production with other sources be it shale, ethanol, or tar sands. These are more intensive to produce and have lower EORI. In a basic nutshell, the industry will need to flat our run in order to stand still.

I forgot about increasing demand in China, India, etc. . Ok, the picture/problem is getting clearer for me. Usable petroleum products are harder and increasingly more expensive to produce, and demand for them continues to increase. Hence, higher prices.SixNein said:The other part of the problem is dealing with global demand:http://en.wikipedia.org/wiki/Automotive_industry_in_the_People's_Republic_of_China

There is also the issue of growing internal demand in exporting nations.

In a basic nutshell, the ultimate problem is gas prices are going climb.

ThomasT said:I see.

I forgot about increasing demand in China, India, etc. . Ok, the picture/problem is getting clearer for me. Usable petroleum products are harder and increasingly more expensive to produce, and demand for them continues to increase. Hence, higher prices.

Any predictions on what it will be in the US in, say, 2020?

A study by a German military think tank has analyzed how "peak oil" might change the global economy. The internal draft document -- leaked on the Internet -- shows for the first time how carefully the German government has considered a potential energy crisis.

http://www.guardian.co.uk/environment/2011/jun/15/peak-oil-warningThe government was warned by its own civil servants two years ago that there could be "significant negative economic consequences" to the UK posed by near-term "peak oil" energy shortages.

The world is much closer to running out of oil than official estimates admit, according to a whistleblower at the International Energy Agency who claims it has been deliberately underplaying a looming shortage for fear of triggering panic buying.

China Encourages Solar-Product Makers to Expand Amid Supply Glut

By Bloomberg News - Feb 24, 2012 8:29 AM CT

China set targets for increasing production capacity at key polysilicon and solar cell makers, part of the government’s plan to ensure its companies survive a slump in prices.

China wants each “leading” company to have 50,000 tons a year of polysilicon capacity by 2015 and targets 5 gigawatts for each of its top solar-cell makers, according to a five-year plan posted on the Ministry of Industry and Information Technology website today.

BP Plans to Withdraw From Solar-Energy Venture in Australia

By James Paton - Feb 24, 2012 1:59 AM CT

BP Plc (BP/), Europe’s second-largest oil company, plans to withdraw from a venture seeking Australian government funds to build a solar-power project in the state of New South Wales.

“We’ve indicated that we wish to leave the consortium and that we won’t be part of the new bid process,” Jamie Jardine, a Melbourne-based spokesman for BP, said by mobile phone today.

...

The company decided to exit the global solar business after 40 years because it has become unprofitable, Mike Petrucci, the chief executive officer of BP’s solar unit, told staff in an internal letter in December. The industry faces oversupply and price pressures after Chinese competitors increased production.

DrClapeyron said:

Electric motors have more than enough 'grunt' for any heavy duty transportation task one cares to imagine, as we all are reminded (or should be) every time we board the electric subway that accelerates 50-200 tons from 0 to 60 mph in 10secs or so. The limitation brought on by batteries lies with long distance range and perhaps extreme temperature cases, for now.apeiron said:I think this may be at the heart of it. We need everyone to switch to electric cars. And then even if we do that, trucks, planes, farm equipment and military hardware still needs the grunt of diesel.

So we are still on track for economic adjustments like we are seeing in Greece right now.

But why look at just crude? During the same 9 years all liquid fuels increased 10-11 mbpd. Consumption is largely agnostic about source.SixNein said:But by looking at current world production for crude, it seems to have leveled off for the last 9 years. What production gains we have had comes from other liquids. ...

Here is a link with a break up on liquids:

http://www.theoildrum.com/files/Screen shot 2012-02-13 at 9.02.36 AM.png

mheslep said:But why look at just crude? During the same 9 years all liquid fuels increased 10-11 mbpd. Consumption is largely agnostic about source.

mheslep said:Electric motors have more than enough 'grunt'...

Yes, of which range is a linear function. At some point though I hope these 50:1 joule/kg comparisons shown in the front matter of these presentations go away, as heat engines inevitably through away more than half of that energy. Then of course diesel and gasoline engines don't run by themselves, they require the additional mass and volume of a fuel pump, oil pump, water pump, an air intake system, exhaust system, starter, large radiator, transmission with four or more gears, differential, on and on, none of which are required in an EV. Apparently a 4:1 range ratio, 400 miles to 100, is the practical ratio today.apeiron said:Energy density is the issue...

http://www.global-greenhouse-warming.com/support-files/biodiesel_deer_future.pdf

mheslep said:That conclusion is not justified, especially given the recession was Fall 2008 and imports have has been falling since 2005.

Yes economic slow downs deserve some of the blame for energy imports and consumption, but other factors apply apply including improvements in economic energy intensity and increase in domestic supply:

1. US energy intensity (energy per unit of economic output) has been cut in half since 1980,and improved 10% the period 2007 to 2010.

3. Ethanol production has doubled in the last couple years (see graph from earlier post), now 1 mbbl/day.

Those three things contribute strongly to the reduction in imports and consumption.

A fair point. Note though that energy prices have a way to go before they are constant around the world, and exports to the highest bidder immediate. Natural gas for instance is priced overseas at several multiples of the of the US price (for now). Bakken oil sells at a $30/bbl discount locally (for now). I doubt a squeeze in supply meeting demand becomes serious enough to stop a build out in more energy infrastructure.

The depends on the efficiency of the biofuel method and the consumption at the time. That 500 bbl/acre-year engineered bacteria approach (should it work) requires 13 million acres to meet all of US current consumption (18 mbbl/day). That compares well to the 90 million acres in use currently for all US corn crops, not that such an approach needs arable land.

CaptFirePanda said:From the plot it is obvious that the numbers have not been in decline since 2005 and looking at the raw data confirms this (with minor dips lasting no longer than a year).mheslep said:That conclusion is not justified, especially given the recession was Fall 2008 and imports have has been falling since 2005.

apeiron said:Energy density is the issue...

http://www.global-greenhouse-warming.com/support-files/biodiesel_deer_future.pdf

mheslep said:To what data are you referring?

http://205.254.135.24/dnav/pet/hist_chart/MTTNTUS2a.jpghttp://205.254.135.24/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mttntus2&f=a

CaptFirePanda said:This is one of my problems... initially we were discussing consumption, then you jumped to supply numbers and now net imports. There are, of course, subtle differences between them all (nickle and diming, as I mentioned).

So, I'm trying to keep track, but obviously it's just as confusing for me.

Well there have been several ups and downs. Here is the consumption data (all liquids) back to '63 this time. Increase up to the '79 Iranian crisis, decline to ~83 then increase, slight decline in 90-91, and then decline again since ~2006-7.CaptFirePanda said:...

I would suggest this is a factor of technology, rather than consumption. As we have seen, consumption has been increasing while production decreasing since 1980.

Yes I am familiar with the ERoEI concept.CaptFirePanda said:Think of it as a a feedback loop. In order to maintain supply to match demand, one needs to expend energy. Greater energy must be spent in order to meet greater demand. ... As resources are depleted, more energy must be expended in order to drill up and find new resources. So, in order for us to keep pace with growing demand, we must spend energy to speed up production and to fill any voids left by depleted resources. We begin to exploit unconventional sources more and more and our dependence shifts from the more conventional sources (which are all on the decline). To get energy, we must spend energy

I don't agree that it will only increase. Yes tar sands initially require more energy than conventional, but from what I read tar sand production energy is declining especially in the last year. I doubt tar sands production energy costs will ever reach conventional, but neither do I see a runaway energy production problem. More like a step increase.CaptFirePanda said:and the energy we need to spend will only increase.

And compared to ~65% in 2005-6.CaptFirePanda said:The US is not an isolated case in the energy cycle. Despite any growing supply from within, consumption still outpaces domestic production by about 40% (compared to 20% in 1980).

One can argue that new production/efficiency is not the entire reason for the closing gap, or that current conditions won't hold in the future, and I'm happy to see those arguments. But as written that statement is simply not true. US oil imports are falling, and have been since 2005, and now so are gas imports.CaptFirePanda said:It is quite apparent that new technologies and new discoveries are not abating the US need for imported hydrocarbons.

Yes, and may never go anywhere. I'm simply pointing out that it is not justifiable to say that land use always rules out any kind of way forward for biofuels. I agree land use rules out a corn ethanol future, but not some of the other far more efficient schemes on the table, and which at least don't violate any laws of physics....These forms of biofuel generation are still in their infancy...

mheslep said:Well there have been several ups and downs. Here is the consumption data (all liquids) back to '63 this time. Increase up to the '79 Iranian crisis, decline to ~83 then increase, slight decline in 90-91, and then decline again since ~2006-7.

Note oil consumption per capita (link up thread) has declined pretty much continuously, showing that more efficient cars/trucks/airplanes/ships, the elimination of oil based electric generation and so on have made a difference in consumption.

Yes I am familiar with the ERoEI concept.

I don't agree that it will only increase. Yes tar sands initially require more energy than conventional, but from what I read tar sand production energy is declining especially in the last year. I doubt tar sands production energy costs will ever reach conventional, but neither do I see a runaway energy production problem. More like a step increase.

And compared to ~65% in 2005-6.

One can argue that new production/efficiency is not the entire reason for the closing gap, or that current conditions won't hold in the future, and I'm happy to see those arguments. But as written that statement is simply not true. US oil imports are falling, and have been since 2005, and now so are gas imports.

Yes, and may never go anywhere. I'm simply pointing out that it is not justifiable to say that land use always rules out any kind of way forward for biofuels. I agree land use rules out a corn ethanol future, but not some of the other far more efficient schemes on the table, and which at least don't violate any laws of physics.

? You mean that, what, the average linear consumption trend for the last several decades is up? Sure, but I hope we agree that recently this is not the case, that the recent consumption figures areCaptFirePanda said:...

This stat can also be atttributed to many other factors that may or may not be at play here (eg. wealth distribution, age distribution, etc...) I'm not saying they would skew the results, I'm just pointing out that overall consumption is still on the rise and it outpaces domestic production.

Perhaps, but in the future we don't know if SAGD will be used over (say) VAPEX that does not require steam. With very cheap natural gas to make steam no doubt SAGD will continue for awhile, but there's no rule mandating that will be the case.CaptFirePanda said:The bulk of oil sands production has come from mining operations to date. Along with that, however, are the SAGD operations. These produce volumes much less than mining operations do (on a one to one comparison), but collectively will account for greater amounts of total contribution to oil sands production. These operations require drilling, thermal processes to create steam, pipelining, etc... and are far less concentrated than mining operations. So, even if energy requirements are decling now they will increase again. SAGD operations will likely account for ~80% of bitumen produced throughout the course of oil sands development.

I respect long term trends. The flip side of long term trends is that reversals never seen before have significance. That's why I see a six year reversal 25% off the peak as significant.CaptFirePanda said:They are falling, but they have only been falling for the last 2-3 years of a 61 year upward trend. As I mentioned above this kind of aberration does not mean much of anything until it becomes a long-term trend. At the moment, it can be explained away by many other factors.

<shrug>I don't know that commercial interests are vying for the vast tracks of barren land in the US, at least they have not so far. Certainly there are groups that want these areas left barren and pristine.CaptFirePanda said:I don't think I said land-use always rules out the concept of biofuels (if I did, I apologize). I think I indicated that land-use issues will be an impediment to these sorts of operations. There are many sectors vying for space and it is very difficult to justify large extents of land for low relatively volumes of fuel.

mheslep said:? You mean that, what, the average linear consumption trend for the last several decades is up? Sure, but I hope we agree that recently this is not the case, that the recent consumption figures are

US Consumption, 4 wk average, all oil, mbpd

Feb 2007 21.8 (all time high US consumption)

Feb 2008 20.6

Feb 2009 19.5

Feb 2010 19.3

Feb 2011 19.4

Feb 2012 18.1

i.e. off 17%, otherwise I'm wasting my time here against some kind of dogmatic belief unchangeable by data.

Perhaps, but in the future we don't know if SAGD will be used over (say) VAPEX that does not require steam. With very cheap natural gas to make steam no doubt SAGD will continue for awhile, but there's no rule mandating that will be the case.

I respect long term trends. The flip side of long term trends is that reversals never seen before have significance. That's why I see a six year reversal 25% off the peak as significant.

<shrug>I don't know that commercial interests are vying for the vast tracks of barren land in the US, at least they have not so far. Certainly there are groups that want these areas left barren and pristine.

Yes so I gather, but I don't understand why.CaptFirePanda said:...I see the "reversal" as somewhat short term and a similar return to business as usual will follow.