Discussion Overview

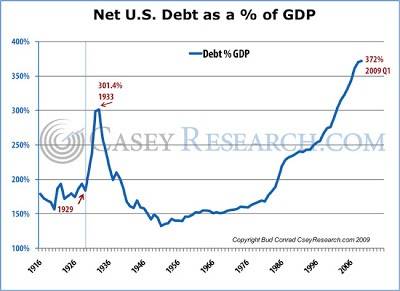

The discussion centers around the interpretation of two different graphs representing US debt and its relation to GDP. Participants explore the implications of total debt versus net debt, the historical context of debt levels, and the economic impact of manufacturing and services on the economy. The scope includes theoretical analysis, economic modeling, and historical comparisons.

Discussion Character

- Debate/contested

- Technical explanation

- Conceptual clarification

Main Points Raised

- Some participants note that the first graph uses total debt while the second uses net debt, suggesting that the curves should align despite differing time spans.

- One participant provides specific figures for US government debt to GDP, indicating a distinction between net and gross debt, and references external reports for further context.

- Another participant highlights that total debt to GDP was historically high in 2007, comparing it to the Great Depression, while noting that non-financial sector debt was on par with that period.

- Concerns are raised about the implications of foreign ownership of US debt, suggesting it may represent a greater economic drain compared to historical contexts.

- Some participants argue that GDP may not accurately reflect the buying power of the population due to changes in the manufacturing sector's contribution to the economy.

- There is a discussion about the productivity gains in manufacturing and agriculture, questioning the relevance of lost jobs in these sectors to overall economic health.

- One participant proposes that debt servicing rates relative to interest rates could provide a clearer picture of the debt burden, suggesting adjustments for inflation to better reflect real buying power.

Areas of Agreement / Disagreement

Participants express multiple competing views regarding the interpretation of debt graphs and their implications for understanding the economy. There is no consensus on which graph represents the true economic picture or the significance of manufacturing versus services.

Contextual Notes

Participants mention various external reports and historical data, but there are unresolved assumptions regarding the definitions of debt types and the implications of economic changes over time.