Stochastic Differential Equation using Ito's Lemma

- Context: MHB

- Thread starter cdbsmith

- Start date

Click For Summary

Discussion Overview

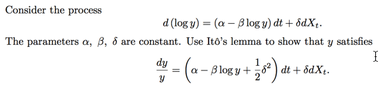

The discussion revolves around the application of Ito's Lemma in the context of Stochastic Differential Equations (SDEs). Participants explore the derivation of an SDE using Ito's Lemma, focusing on the transformation of variables and the mathematical steps involved in the process.

Discussion Character

- Technical explanation

- Mathematical reasoning

- Homework-related

Main Points Raised

- One participant expresses confusion about Ito's Lemma and requests assistance in understanding it.

- Another participant provides a derivation involving a process defined by $dY_t = \mu_t dt + \sigma_t\, dX_t$, applying Ito's Lemma to a function $g(u) = e^u$ where $u = \log y$.

- The derivation includes several mathematical expressions, detailing the transformation from $du$ to $dy$ using Ito's Lemma.

- A further request for clarification on the steps taken in the derivation indicates ongoing confusion and a desire for a more detailed explanation.

- A participant explains the conditions under which Ito's Lemma applies, mentioning the continuity requirements for the function involved.

Areas of Agreement / Disagreement

Participants generally agree on the application of Ito's Lemma and the mathematical steps involved, but there remains uncertainty regarding the understanding of these steps, as indicated by requests for further clarification.

Contextual Notes

Some participants note the specific conditions required for applying Ito's Lemma, such as the differentiability of the function involved, but these conditions are not fully resolved in the discussion.

Similar threads

- · Replies 3 ·

- · Replies 2 ·

- · Replies 1 ·

- · Replies 1 ·

- · Replies 1 ·

- · Replies 7 ·

Undergrad

Stopping Time in layman's words

- · Replies 6 ·

- · Replies 1 ·

- · Replies 5 ·

- · Replies 2 ·