SUMMARY

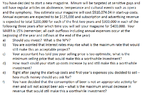

The discussion centers on investment decision-making, specifically addressing questions 3 to 6 related to a financial scenario involving a $50,000 investment, a 17.27% return, and various financial figures including expenses of $125,000, revenues of $200,000 and $300,000, and a selling price of $400,000. The user questions the rationale behind a purchase amount of $510,074.04, labeling it as an unreasonable figure. The conversation emphasizes the importance of clear financial metrics in investment analysis.

PREREQUISITES

- Understanding of basic investment principles

- Familiarity with financial metrics such as ROI and revenue projections

- Knowledge of expense management in investment scenarios

- Ability to analyze and interpret financial statements

NEXT STEPS

- Research investment analysis techniques using Excel

- Learn about calculating Return on Investment (ROI) in various scenarios

- Explore financial modeling for revenue and expense forecasting

- Study the implications of purchase price on investment viability

USEFUL FOR

Investors, financial analysts, and anyone involved in making informed investment decisions based on financial metrics and projections.