jgiannis

- 2

- 0

Hi.

I am looking into buying a home. I am trying to calculate the monthly "Principal + Interest." My bank actually provides a neat calculator that removes all of the guesswork (https://www.schoolsfirstfcu.org/wps/portal/Calculator?calculatorParamKey=MortgageCompare).

However, for the fun of math, I tried reaching the same value by using logic in my equation. But it turns out that my equation comes out different than the result from the bank's calculator.

Can anyone explain where my logical approach goes wrong?

Given the following information, here's how I ran the equation, from scratch, using logic:

Total Price of Home: $350,000

Down Payment (20%): $70,000

Principal Loan Amount to be Financed: $280,000

Interest Rate (APR-FIXED): 3.5%

Duration of Loan: 30 years

Frequency of Payment (monthly): 12

Thus, I figure that if I'm paying 3.5% per year on $280k, then every year I would be paying this much in interest: ($280k)*(0.035) = $9,800.

Thus, in 30 years, the total amount of interest that I would pay is: ($9,800)*(30) = $294,000.

Thus, the total amount of Principal + Interest that I would pay after 30 years would be: ($280,000)+($294,000) = $574,000

Thus, since there are 360 months in 30 years, the monthly cost of Principal + Interest would be: ($574,000)/(360) = $1,594.44.

However, using those same numbers, my bank's calculator says that the Principal + Interest would actually be $1,257.33.

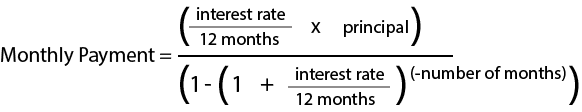

I should note that I trust my bank's numbers. I found a finance equation online, and using that equation, I get the same result as my bank. However, the things that puzzle me so much are (a) where did my logical approach go wrong, and (b) what is the logic behind the "correct" financial equation? To me, the "correct" financial equation makes no sense. I do not see the logic in it. Here is the equation that I'm speaking of:

Also, to make things a bit more complicated, I was helping someone calculate a monthly car loan. Here's the given information:

Total Price of Car: $21,000

Down Payment: $7,000

Principal Loan Amount to be Financed: $14,000

Interest Rate (APR-FIXED): 9%

Duration of Loan: 5 years

Frequency of Payment (monthly): 12

I used the equation above, and I get a value of $290.62. Sounds good.

I also used my own logical approach, and I get a value of $338.33. Also sounds good, but based on the above home loan discussion, I assume this is wrong.

The thing that puzzles me this time around is that the car dealership quoted us $338.33. It sounds like they used the same approach as I initially thought of. Why? Is there typically a different calculation in Home Loans vs Car Loans? Thanks for your time.

I am looking into buying a home. I am trying to calculate the monthly "Principal + Interest." My bank actually provides a neat calculator that removes all of the guesswork (https://www.schoolsfirstfcu.org/wps/portal/Calculator?calculatorParamKey=MortgageCompare).

However, for the fun of math, I tried reaching the same value by using logic in my equation. But it turns out that my equation comes out different than the result from the bank's calculator.

Can anyone explain where my logical approach goes wrong?

Given the following information, here's how I ran the equation, from scratch, using logic:

Total Price of Home: $350,000

Down Payment (20%): $70,000

Principal Loan Amount to be Financed: $280,000

Interest Rate (APR-FIXED): 3.5%

Duration of Loan: 30 years

Frequency of Payment (monthly): 12

Thus, I figure that if I'm paying 3.5% per year on $280k, then every year I would be paying this much in interest: ($280k)*(0.035) = $9,800.

Thus, in 30 years, the total amount of interest that I would pay is: ($9,800)*(30) = $294,000.

Thus, the total amount of Principal + Interest that I would pay after 30 years would be: ($280,000)+($294,000) = $574,000

Thus, since there are 360 months in 30 years, the monthly cost of Principal + Interest would be: ($574,000)/(360) = $1,594.44.

However, using those same numbers, my bank's calculator says that the Principal + Interest would actually be $1,257.33.

I should note that I trust my bank's numbers. I found a finance equation online, and using that equation, I get the same result as my bank. However, the things that puzzle me so much are (a) where did my logical approach go wrong, and (b) what is the logic behind the "correct" financial equation? To me, the "correct" financial equation makes no sense. I do not see the logic in it. Here is the equation that I'm speaking of:

Also, to make things a bit more complicated, I was helping someone calculate a monthly car loan. Here's the given information:

Total Price of Car: $21,000

Down Payment: $7,000

Principal Loan Amount to be Financed: $14,000

Interest Rate (APR-FIXED): 9%

Duration of Loan: 5 years

Frequency of Payment (monthly): 12

I used the equation above, and I get a value of $290.62. Sounds good.

I also used my own logical approach, and I get a value of $338.33. Also sounds good, but based on the above home loan discussion, I assume this is wrong.

The thing that puzzles me this time around is that the car dealership quoted us $338.33. It sounds like they used the same approach as I initially thought of. Why? Is there typically a different calculation in Home Loans vs Car Loans? Thanks for your time.