indigo2

- 2

- 0

Hello :)

I was given this task:

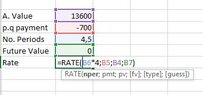

A quarterly deposit is €700 in 4.5 years, and the accumulated value is €13,600. What is the value of annual interest rate?

And I would apply this formula:

S = [((1+i)n - 1) / i] ∙ R

€13,600 = [((1+i)18 - 1) / i] ∙ €700

To find out the annual interest rate I have to use the RATE function in excel but my solution is -1% for i.

View attachment 8198

What do I do wrong?

THANK YOU FOR ANY ADVICE :)

I was given this task:

A quarterly deposit is €700 in 4.5 years, and the accumulated value is €13,600. What is the value of annual interest rate?

And I would apply this formula:

S = [((1+i)n - 1) / i] ∙ R

€13,600 = [((1+i)18 - 1) / i] ∙ €700

To find out the annual interest rate I have to use the RATE function in excel but my solution is -1% for i.

View attachment 8198

What do I do wrong?

THANK YOU FOR ANY ADVICE :)