What is the correct formula for calculating savings plan?

- Context: MHB

- Thread starter Ladybug101

- Start date

-

- Tags

- Plan Word problem

Click For Summary

SUMMARY

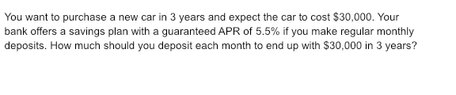

The correct formulas for calculating a savings plan are either S_{Ordinary}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}} for ordinary annuities or S_{Due}=p\frac{\left(1+\frac{r}{n}\right)^{ny}-1}{\frac{r}{n}}\left(1+\frac{r}{n}\right) for annuities due. The choice between these formulas depends on whether deposits are made at the beginning or the end of the month. To accumulate a target amount, it is essential to clarify the timing of deposits, which will dictate the appropriate formula to use.

PREREQUISITES- Understanding of annuities and their types (ordinary vs. due)

- Familiarity with the formula for future value of annuities

- Basic knowledge of interest rates and compounding periods

- Ability to perform algebraic calculations

- Study the future value of ordinary annuities and annuities due in detail

- Practice using the formulas with different interest rates and time periods

- Explore financial calculators that can automate these calculations

- Review examples of savings plans in financial textbooks or online resources

Students studying finance, financial planners, and anyone looking to understand savings plans and annuity calculations.

Similar threads

- · Replies 1 ·

- · Replies 4 ·

- · Replies 29 ·

- · Replies 1 ·

- · Replies 57 ·

- · Replies 1 ·

High School

Question about Compound Interest Formula

- · Replies 6 ·

- · Replies 3 ·

- · Replies 1 ·

- · Replies 3 ·