Physics-Learner

- 297

- 0

lisab said:Very simplistic world view, IMO.

as mr. spock would say - "why, thank you".

The discussion revolves around the taxation of the wealthy in America, particularly focusing on perspectives regarding Warren Buffet's views on tax policy and the implications of tax structures on different income groups. Participants explore the fairness of the current tax system, the impact of taxes on economic behavior, and the political motivations behind arguments for and against taxing the rich. The scope includes theoretical and conceptual considerations, as well as personal opinions on economic policies.

Participants exhibit a range of competing views on the effectiveness and fairness of current tax policies for the wealthy. There is no consensus on the implications of Buffet's arguments or the best approach to taxation, indicating an unresolved debate.

Limitations in the discussion include varying assumptions about income levels among Buffet's employees, the complexity of tax benefits over a lifetime, and the economic realities of supply and demand in relation to taxation. These factors contribute to differing interpretations of the impact of tax policies.

lisab said:Very simplistic world view, IMO.

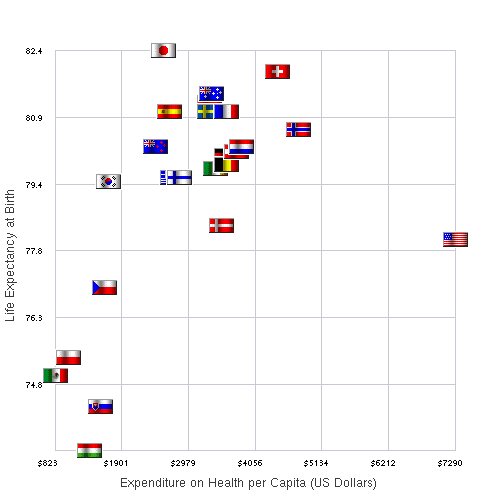

There couldn't be a less reliable stat than life expectancy on that issue. Cultural and government bias issues play such a huge role that the relatively tiny differences are swamped by the noise.DevilsAvocado said:Really? That’s not what I have heard:

Life Expectancy vs Health Care Spending in 2007 for OECD Countries. The data source is http://www.oecd.org

Do you have another source?

For instance:DevilsAvocado said:Really? That’s not what I have heard:

...

Do you have another source?

Yep. If one doesn't get killed at 23 in, say, a car wreck or by gunshot then US lifespan looks pretty good.russ_watters said:There couldn't be a less reliable stat than life expectancy on that issue. Cultural and government bias issues play such a huge role that the relatively tiny differences are swamped by the noise.

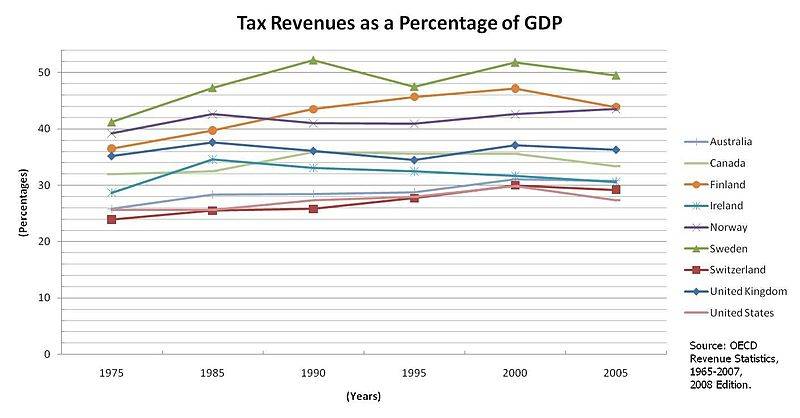

DevilsAvocado said:In theory, maybe yes, in practice – I say it all depends on how you do it. If you do investments in infrastructure, education, research, new technology, startups, etc – high taxes can actually mean a growing economy.

I can’t help laughing when I see (the same old freaks) going baloney over taxes, as it was some form of communist virus from hell.

I live in a country which has one of the highest taxes in the world, as a percentage of GDP:

As you can see, we have twice as much tax revenues as the United States, TWICE!

Do we walk around in Karl Marx beards and fight over the one and only loaf in the supermarket?

No.

At the moment, we are http://en.wikipedia.org/wiki/EU_economy#Economies_of_member_states", 5.54% annual change of GDP, and United States has 2.8%.

This means you have a *HUGE* opportunity (i.e. margin) to fix your economy in a fairly simple way, if you could just relax a little bit, and realize that taxes are not equal to Stalinism.

Really? That’s not what I have heard:

Life Expectancy vs Health Care Spending in 2007 for OECD Countries. The data source is http://www.oecd.org

Amp1 said:I haven't finished reading this thread but who-wee from post #14 insists Warren's company as opposed to the man pays billions in taxes. I wonder if its billions a year, every ten years, a decade, what is the amount his company pays per year? How much would it be without the tax accountants? Maybe his accounts are not as good as G.E.'s and that's why his company pays BILLIONS probably.

CAC1001 said:Comparing Sweden to a nation like the United States which is immensely more complex in terms of the mix of cultures, ethnicities, religions, languages, and so forth, with a population of more than 300 million people, well it's just not a proper comparison.

MarcoD said:I agree with that. But sometimes conservatives in the US state postulates as if they are axioms. Sweden has 50% taxation, a 33% GDP government deficit, and 33% of the population is employed by the government - and the country works.

If you borrow 40 cents on the dollar, everybody know you need to cut spending and increase revenue. It is a no-brainer.

Whatever, Sweden is a socialist country in US terms, and the US is an experiment in anarchy in EU terms. To each it's own.

Amp1 said:Thanks, Who-wee. So his multi-billion $ company pays ~ 4 billion a year give or take. Thats out of (rough addition of nets) ~ 463 billion over the same period of time. So the company still netted after tax revenue of ~ 430 billion, not bad.

russ_watters said:There couldn't be a less reliable stat than life expectancy on that issue. Cultural and government bias issues play such a huge role that the relatively tiny differences are swamped by the noise.

mheslep said:For instance:

http://v1.theglobeandmail.com/v5/content/pdf/CONCORD.pdf, Figure 1, page 11.

CAC1001 said:The thing is, we already pretty much have all of that. We aren't an under-developed country.

CAC1001 said:We have lots of infrastructure as is, it just needs repairing.

CAC1001 said:You have a a smarter government there that is wiser with its fiscal policy.

CAC1001 said:The view that raising taxes will fix the USA's problems is just as simplistic as the view that the solution is to massively reduce the size of the government. As for Sweden itself, you're talking about a country much different to a country like the U.S. One big difference is that Sweden has a relatively efficient government with fairly low levels of corruption. Usually countries with high levels of social trust have decent public institutions, and Sweden is just such a country. The thing is that the conditions for having such a high-level of trust in a society are that it usually is relatively homogenous ethnically, religiously, linguisticallly, etc...and rather small. Sweden has a little less than 10 million people. You'll find about that same amount in either Los Angeles or New York City alone over here in the states. And if you notice, cities like LA and NY are not ethnically, religiously, linguistically, homogenous, but instead are a whole mix of those things, which has created all sorts of complexities within those cities over the years. Comparing Sweden to a nation like the United States which is immensely more complex in terms of the mix of cultures, ethnicities, religions, languages, and so forth, with a population of more than 300 million people, well it's just not a proper comparison.

CAC1001 said:Life expectancy unto itself is inaccurate

MarcoD said:I agree with that. But sometimes conservatives in the US state postulates as if they are axioms. Sweden has 50% taxation, a 33% GDP government deficit, and 33% of the population is employed by the government - and the country works.

MarcoD said:If you borrow 40 cents on the dollar, everybody know you need to cut spending and increase revenue. It is a no-brainer.

MarcoD said:Whatever, Sweden is a socialist country in US terms, and the US is an experiment in anarchy in EU terms. To each it's own.

Yes. Buffet and other billionaires do not have to worry about the regressive hidden taxes that are foisted upon the US populace by misguided tax policies. The taxes that he writes about publicly, including income taxes, payroll taxes, estate taxes, and capital gains taxes don't hold a candle to the regressive hidden taxes (in the form of higher prices) that the middle-class and lower-class are nailed with in order to supply subsidies and tax-breaks to mega-businesses, including the ethanol industry. There is probably no way to get this complex situation across in a prime-time news program, but the story needs to be told.WhoWee said:Are we still talking about Warren Buffet and his taxes?

turbo said:Yes. Buffet and other billionaires do not have to worry about the regressive hidden taxes that are foisted upon the US populace by misguided tax policies. The taxes that he writes about publicly, including income taxes, payroll taxes, estate taxes, and capital gains taxes don't hold a candle to the regressive hidden taxes (in the form of higher prices) that the middle-class and lower-class are nailed with in order to supply subsidies and tax-breaks to mega-businesses, including the ethanol industry. There is probably no way to get this complex situation across in a prime-time news program, but the story needs to be told.

I have friends that are retired and are trying to get by on their SS benefits, savings, etc. There has been no SS COLA increase in years, despite the fact that heating fuel and food are becoming increasingly expensive. At some point, we need to put some adults in DC or put vulnerable people increasingly at risk. I have a neighbor that is not in the best of health, but at 70+ years old, he has to take on jobs mowing, raking snow off roofs, etc to supplement his SS.

turbo said:I have a neighbor that is not in the best of health, but at 70+ years old, he has to take on jobs mowing, raking snow off roofs, etc to supplement his SS.

DevilsAvocado said:While gazillionaire’s get tax reduction for private jets... this can’t be right.

Buffett is Right: Raise Taxes on the Wealthy

Households in the top 1% of the distribution can afford to contribute. They have done enormously well during the past 30-plus years. In 1979, their income accounted for 10% of total income. According to the most recent data (from 2008), their share of total household income more than doubled to 21%. In contrast, real income for middle-class workers has remained roughly constant over the same time frame.

One good place to start? High-income households: Limit the rate at which itemized deductions can occur to 28%. This would affect only households in the highest income ranges, it would not raise their official marginal tax rate, and it would raise $293 billion over the next decade, relative to how much money would be raised according to current law, according to the Congressional Budget Office.

Eventually, the nation will need to deal with the ballooning costs of Medicare, Medicaid and Social Security... There are good options there as well, including a value-added tax – the equivalent of a national consumption tax and a feature of the tax system of every industrialized country except the U.S. – and higher energy taxes, to promote a cleaner environment as well as raise revenues.

http://www.taxpolicycenter.org/publications/url.cfm?ID=901442

apeiron said:Some arguments backed by relevant facts from the Tax Policy Center...

WhoWee said:If everyone agrees - it raises $29.3 Billion per year - now what?

apeiron said:Err, that was $293b. And that's just for tackling the most egregious 'gazillionaire’s get tax reduction for private jets' type stuff.