- #1

logicandtruth

- 11

- 0

Hi all

Trying to improve my level of maths and would like some help with the below question please.

A 10-year lease with annual rental payments to be made at the end of each year, with the rent increasing by 2% each year. If the first year rent is £20 and the OCC is 10% per year, what is the Present value of the lease?

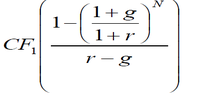

The formula for present value of a level annuities is below (for a growing interest rate)

View attachment 8227

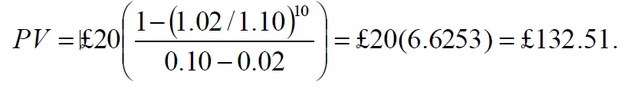

According to my book the answer should be £132.51, but I get -23.88.

View attachment 8228

Could anyone tell me where I am misinterpreting the formula?

Trying to improve my level of maths and would like some help with the below question please.

A 10-year lease with annual rental payments to be made at the end of each year, with the rent increasing by 2% each year. If the first year rent is £20 and the OCC is 10% per year, what is the Present value of the lease?

The formula for present value of a level annuities is below (for a growing interest rate)

View attachment 8227

According to my book the answer should be £132.51, but I get -23.88.

View attachment 8228

Could anyone tell me where I am misinterpreting the formula?