- #1

ChiralSuperfields

- 1,216

- 132

- Homework Statement

- please see below

- Relevant Equations

- please see below

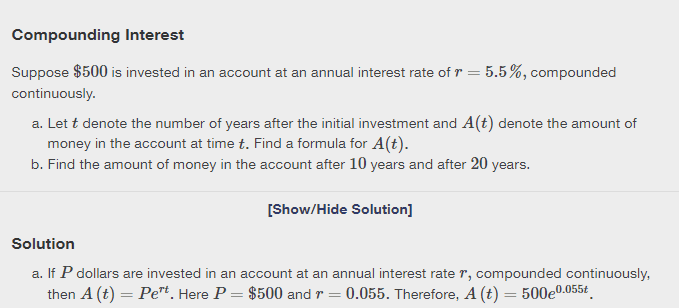

For this part (a),

I got ##A(t) = 500 \times 6.5^t## where t is in years. Does someone please know whhy their function is to base e? Is it because the money is compounded continuously?

Many thanks!

I got ##A(t) = 500 \times 6.5^t## where t is in years. Does someone please know whhy their function is to base e? Is it because the money is compounded continuously?

Many thanks!