- #1

NotaMathPerson

- 83

- 0

Hello everyone!

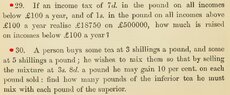

I need help on setting the equations for these problems.View attachment 5643

For prob 30. I could not solve it because there's no given amount in lbs of the mixture.

For prob 28 I really had no idea what it is asking.

Please bear with the monetary unit used those problems. These problems are from very old book.

Thanks!

I need help on setting the equations for these problems.View attachment 5643

For prob 30. I could not solve it because there's no given amount in lbs of the mixture.

For prob 28 I really had no idea what it is asking.

Please bear with the monetary unit used those problems. These problems are from very old book.

Thanks!