- #1

Petr Rygr

- 1

- 0

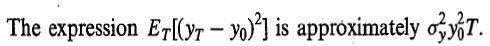

Hello, could anyone please explain me some logic or derivation behind the approximation:

Found it in the Hull Derivatives book without further explanation. Thanks for help

Found it in the Hull Derivatives book without further explanation. Thanks for help