- #1

BilPrestonEsq

- 43

- 0

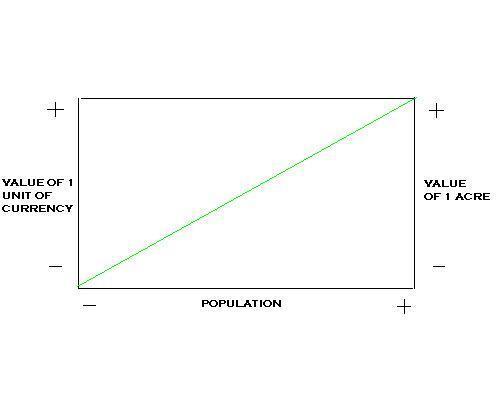

I also could have titled this thread "Argument for Fixed Money Supply". First of all the term 'value' will be defined as: "relative worth, merit, or importance". Also fixed: "not subject to change" This argument is based on two truths:

1. Population dictates the value of land. The value of land will increase according to an increase in population. There is a fixed suppy of land available on Earth. Increase in demand through an increase in population relative to fixed supply of land will increase land values.

2. A fixed money supply in relation to a growing population will lead to a growing demand for each unit of currency. This growing demand for each unit of currency in relation to a fixed supply will increase the value of each unit of currency. Population dictates the value of currency if money supply is fixed.

In a fixed money supply economy, population dictates the value of both land and currency. A rise in population= a rise in value of both land and currency based on supply and demand.

Hmmm...

1. Population dictates the value of land. The value of land will increase according to an increase in population. There is a fixed suppy of land available on Earth. Increase in demand through an increase in population relative to fixed supply of land will increase land values.

2. A fixed money supply in relation to a growing population will lead to a growing demand for each unit of currency. This growing demand for each unit of currency in relation to a fixed supply will increase the value of each unit of currency. Population dictates the value of currency if money supply is fixed.

In a fixed money supply economy, population dictates the value of both land and currency. A rise in population= a rise in value of both land and currency based on supply and demand.

Hmmm...

Last edited: