- #1

Jarek 31

- 158

- 31

Imagine civilization gets a positive feedback mechanism for wasting resources, like cryptocurrencies: “one gets $100 banknote if burning $99 worth resources”, leading to exponential growth of waste at individual gains.

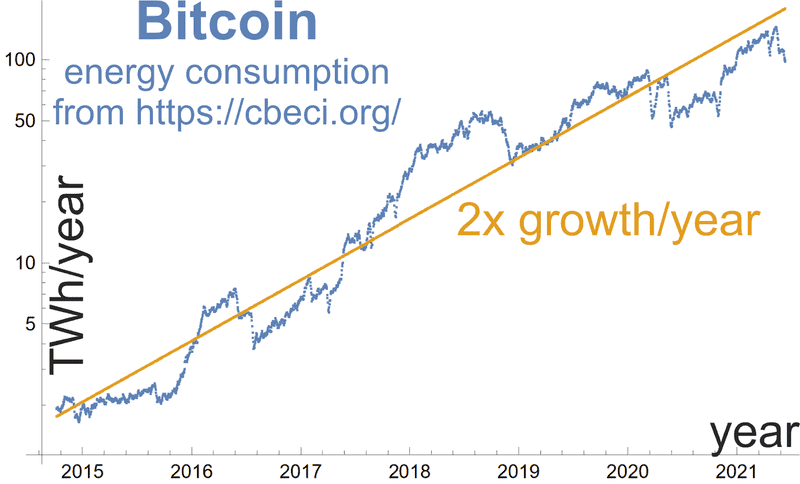

We can observe exponential growth of their energy consumption (below), worsening shortages of electronics, simultaneously these cult-like societies are growing in power/influence, can buy politicians (e.g. El Salvador) … further taking control of chip manufacturers and power plants, in a few years growing to 50%, 90%, 99% of world energy production?

Can such positive feedback be always balanced on a reasonable level, instead of approaching 100% of resources of civilization? In other words: could it lead to fading out end of civilization – as a way for “It is the nature of intelligent life to destroy itself” explanation of Fermi paradox? How frequent could it be? What are the chances for our civilization?

ps. Bitcoin energy consumption from https://cbeci.org/, nearly exactly 2x growth per year - in 6 years should grow from 1% to ~60% of world energy production:

We can observe exponential growth of their energy consumption (below), worsening shortages of electronics, simultaneously these cult-like societies are growing in power/influence, can buy politicians (e.g. El Salvador) … further taking control of chip manufacturers and power plants, in a few years growing to 50%, 90%, 99% of world energy production?

Can such positive feedback be always balanced on a reasonable level, instead of approaching 100% of resources of civilization? In other words: could it lead to fading out end of civilization – as a way for “It is the nature of intelligent life to destroy itself” explanation of Fermi paradox? How frequent could it be? What are the chances for our civilization?

ps. Bitcoin energy consumption from https://cbeci.org/, nearly exactly 2x growth per year - in 6 years should grow from 1% to ~60% of world energy production: