- #1

adska

- 3

- 0

I am developing a market trade bot and need to extract some parameters from market data but I don't have idea how to do it exactly. need your help.

1) How to reproduce if market is increasing or decreasing at certain point? (ex. see below picture)

View attachment 9558

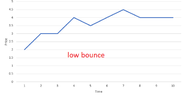

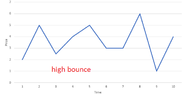

2) Does exist any formula how to reproduce index or something which would show how strongly market price is bouncing? it means if there are huge price spikes in short time then bouncing is big, if price spikes or not high or rare in time then bouncing is not high. (ex. see below pictures)

View attachment 9559

View attachment 9560

Thanks for any help, any programming libraries or tools which would help to solve these problems are welcome too.

1) How to reproduce if market is increasing or decreasing at certain point? (ex. see below picture)

View attachment 9558

2) Does exist any formula how to reproduce index or something which would show how strongly market price is bouncing? it means if there are huge price spikes in short time then bouncing is big, if price spikes or not high or rare in time then bouncing is not high. (ex. see below pictures)

View attachment 9559

View attachment 9560

Thanks for any help, any programming libraries or tools which would help to solve these problems are welcome too.