- #1

Posty McPostface

- 27

- 7

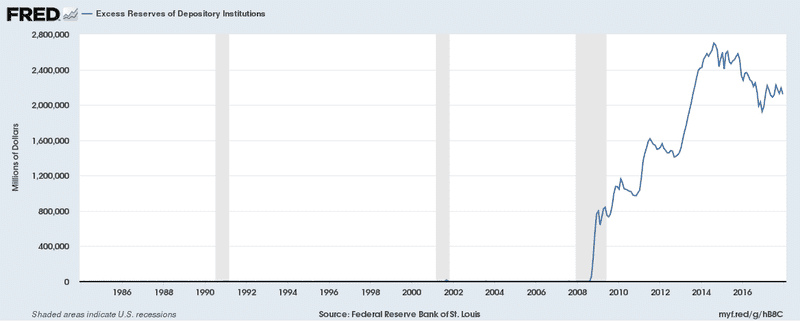

Chart:

Source.

So, inflation has been low, which has been troubling economists and the FED over the effectiveness of undertaken Quantitive Easing (QE).

What's the cause of this, and are banks holding onto excess reserves the real issue here? What are your thoughts about all this liquidity in bank reserves?

Source.

So, inflation has been low, which has been troubling economists and the FED over the effectiveness of undertaken Quantitive Easing (QE).

What's the cause of this, and are banks holding onto excess reserves the real issue here? What are your thoughts about all this liquidity in bank reserves?