SafiBTA

- 9

- 0

- This may be a stupid question as I am totally new to the concept of interest. I don't even know if my question is valid.

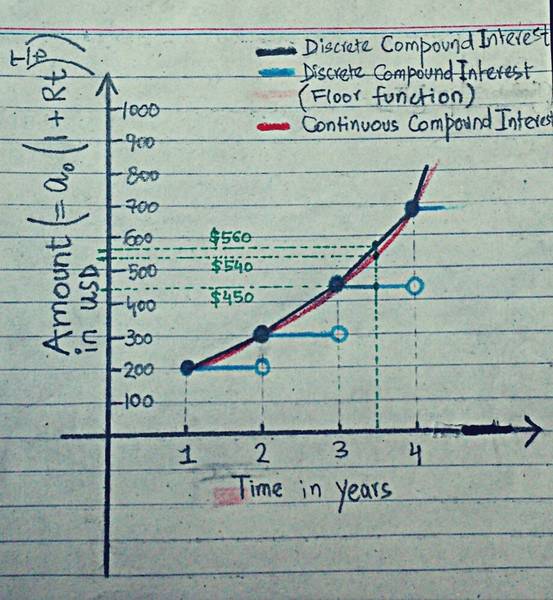

- Figure is given below for referenceSuppose I deposit some money in a bank that pays compound interest on yearly basis. If I decide to withdraw my amount at the end of 3.5 years, which of the following amounts will the bank pay me back:

a. the amount accumulated at the end of 3 years ($450, as represented by blue plot)

b. the amount accumulated at the end of 3 years + a simple interest on this amount computed over 6 months

($560, as represented by the black plot; since compound interest is essentially the simple interest on the last accumulated amount)

c. the amount accumulated at the end of 3.5 years ($540, represented by red plot)

As far as I can think, it can't be c since the interest is compounded discretely and not continuously.

How is this problem usually tackled?

It looks like the amount depends upon the regional laws, but I just want to clarify my concepts.

- Figure is given below for referenceSuppose I deposit some money in a bank that pays compound interest on yearly basis. If I decide to withdraw my amount at the end of 3.5 years, which of the following amounts will the bank pay me back:

a. the amount accumulated at the end of 3 years ($450, as represented by blue plot)

b. the amount accumulated at the end of 3 years + a simple interest on this amount computed over 6 months

($560, as represented by the black plot; since compound interest is essentially the simple interest on the last accumulated amount)

c. the amount accumulated at the end of 3.5 years ($540, represented by red plot)

As far as I can think, it can't be c since the interest is compounded discretely and not continuously.

How is this problem usually tackled?

It looks like the amount depends upon the regional laws, but I just want to clarify my concepts.