OmCheeto

Gold Member

- 2,509

- 3,504

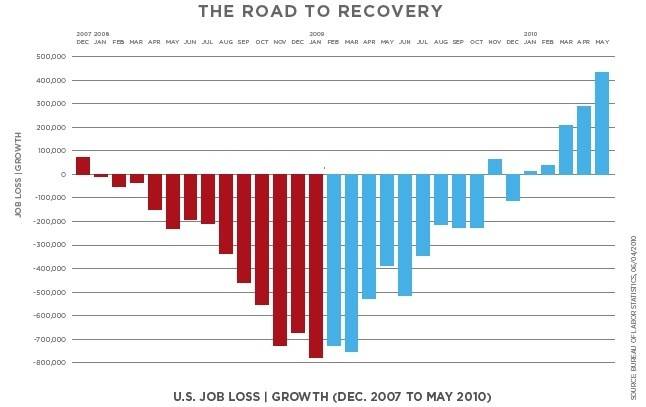

The latest graph is in:

Oh drats. What's this:

hmmm... Maybe we could put the ex-census workers to work cleaning up the gulf coast, along with an extra 200,000 unemployed. That'll keep the graph rolling.

Oh drats. What's this:

http://www.bls.gov/news.release/empsit.nr0.htm" -- MAY 2010

Total nonfarm payroll employment grew by 431,000 in May, reflecting

the hiring of 411,000 temporary employees to work on Census 2010, the

U.S. Bureau of Labor Statistics reported today. Private-sector employment

changed little (+41,000). Manufacturing, temporary help services,

and mining added jobs, while construction employment declined.

The unemployment rate edged down to 9.7 percent.

hmmm... Maybe we could put the ex-census workers to work cleaning up the gulf coast, along with an extra 200,000 unemployed. That'll keep the graph rolling.

Last edited by a moderator: